Insure With Self-confidence: Exploring the World of Auto Insurance and Its Advantages

Are you prepared to strike the open road with assurance? Look no more than automobile insurance policy. With its numerous advantages and benefits, car insurance coverage is an essential for any motorist. In this write-up, we'll explore the world of cars and truck insurance, from the different protection alternatives to factors that affect your premiums. Prepare yourself to pick the right automobile insurance policy provider and insure with confidence.

Kinds of Auto Insurance Policy Insurance Coverage

To totally protect yourself and your vehicle, it is essential to comprehend the different kinds of vehicle insurance coverage available. With the best insurance, you can have comfort knowing you're covered in instance of a crash or damages to your car.

The very first sort of vehicle insurance protection is responsibility insurance coverage. This protection is required by regulation in the majority of states and assists pay for the various other celebration's medical expenses and home damage if you're at mistake in a mishap. It's important to have sufficient liability insurance coverage to safeguard your properties in situation of a lawsuit.

Following, there's collision protection. This sort of insurance policy helps cover the price of repair work or replacement of your automobile if it's harmed in an accident, no matter who is at fault. This insurance coverage is especially crucial if you have a newer or extra pricey cars and truck.

Comprehensive coverage is one more kind of car insurance coverage that protects you against non-collision events, such as burglary, criminal damage, or damage from natural catastrophes. If you live in a location vulnerable to these kinds of incidents., it's a great idea to have this protection.

Ultimately, uninsured/underinsured vehicle driver coverage offers security if you're associated with a crash with a driver who doesn't have insurance or doesn't have sufficient protection to spend for the problems. This protection assists cover your clinical expenditures and property damage.

Understanding the different sorts of car insurance coverage available is crucial for protecting yourself and your vehicle. Make sure you choose the coverage that ideal matches your demands and provides you the satisfaction you should have.

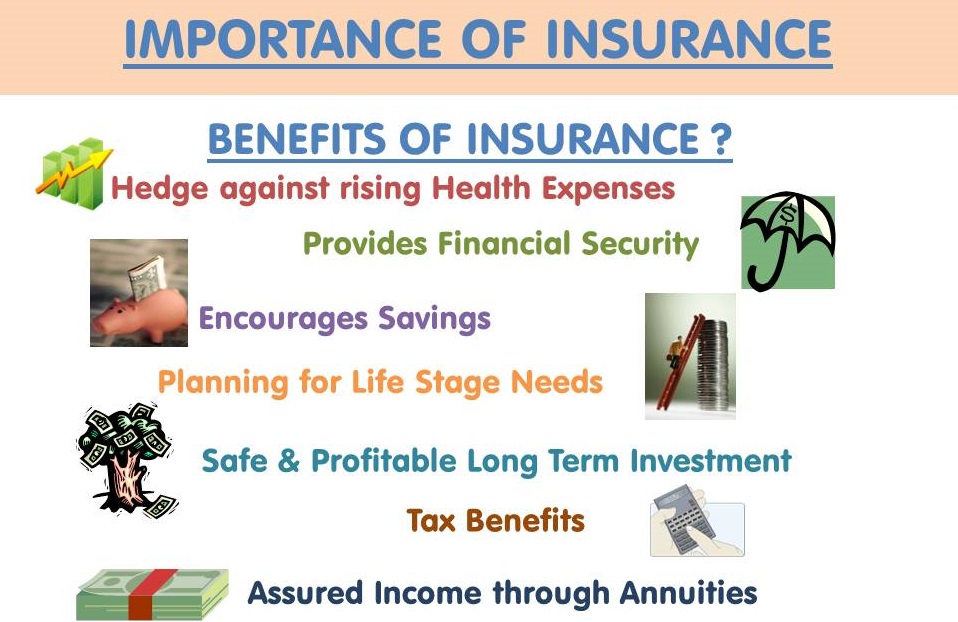

Significance of Automobile Insurance Coverage

Vehicle insurance is a vital investment for safeguarding on your own and your lorry. It supplies monetary safety and security in case of crashes or damages to your cars and truck, guaranteeing that you are not burdened with substantial fixing or medical expenses. Without auto insurance policy, you may have to spend for these expenses expense, which can be frustrating and put a pressure on your funds.

One of the main factors automobile insurance is necessary is since it is legally called for in many states. Driving without insurance policy can result in penalties, license suspension, and even legal repercussions. By having vehicle insurance policy, you abide by the regulation and prevent possible charges.

Cars and truck insurance coverage also gives comfort. Knowing that you are financially secured in case of a crash can ease stress and enable you to drive with self-confidence. Whether it's a minor minor car accident or a major crash, your insurance policy coverage will assist cover the expenses of repair services, clinical expenses, and legal costs.

Additionally, auto insurance coverage shields you from obligation. If you create an accident that harms another person's home or wounds another individual, your insurance coverage will cover the expenses linked with their losses. This can avoid you from needing to spend for these problems out of your very own pocket, potentially saving you countless bucks.

Factors Impacting Car Insurance Coverage Premiums

When identifying your cars and truck insurance policy costs, different aspects come right into play that can substantially affect the expense. If you have a history of mishaps or traffic violations, insurance companies see you as a greater threat and will certainly bill you much more for coverage.

Insurance coverage firms take right into account the make, model, and year of your lorry when determining your premium. Autos that are a lot more expensive to fix or are frequently targeted by burglars will result in greater premiums.

Your age and sex can likewise impact your cars and truck insurance costs. Younger this content motorists, especially young adults, are considered higher risk as a result of their lack of experience on the roadway. Because of this, their costs tend to be greater. Similarly, male motorists typically have greater costs than female motorists due to the fact that statistics reveal that men are more probable to be involved in mishaps.

Other elements that can impact your automobile insurance policy costs include your area, yearly gas mileage, and credit rating. Living in an area with higher criminal offense rates or a high number of accidents can result in higher premiums. Additionally, if you drive a great deal of miles each year, you may face higher costs due to the fact that you get on the roadway a lot more often. Insurance companies might consider your credit report score when determining your costs, as researches have shown that people with lower credit history scores are extra most likely to file cases.

When choosing insurance coverage,Understanding the variables that affect your cars and truck insurance costs can help you make notified choices. By considering these aspects and functioning to improve them, you may have the ability to lower your premiums and conserve cash on your vehicle insurance policy.

Advantages of Having Vehicle Insurance Coverage

By having auto insurance, you can secure on your own versus financial losses resulting from mishaps or damages to your lorry. Vehicle insurance offers you with tranquility of mind recognizing that if you are involved in a mishap, your insurance coverage will certainly cover the price of repairs or replacement of your car. This indicates that you will not need to bother with spending for these expenses out of pocket, which can be quite expensive.

Along with covering the cost of repair work or replacement, cars and truck insurance policy additionally gives you with defense versus responsibility. If you are at fault in an accident and someone is hurt or their building is harmed, your insurance policy will certainly cover the expenses related to those damages. This can consist of clinical costs, legal costs, and building fixings. Without insurance policy, you would be liable for paying these expenses yourself, which can be financially ruining.

An additional benefit of having car insurance policy is that it offers you with roadside aid. If your cars and truck breaks down or you have a flat tire, your insurance policy can offer you with aid such as towing, fuel distribution, or locksmith solutions. This can save you time and cash, as you will not have to locate and pay read review for these solutions on your own.

Exactly How to Choose the Right Cars And Truck Insurance Supplier

Firstly, you ought to examine the reputation and monetary security of the insurance company. Try to find service providers with a solid performance history of customer complete satisfaction and declares handling. Examine their financial ratings to ensure they have the sources to pay cases promptly and effectively.

Following, take into consideration the insurance coverage alternatives supplied by each carrier. You'll wish to pick a plan that satisfies your certain requirements and offers sufficient protection. Look for coverage alternatives such as responsibility, crash, detailed, and uninsured/underinsured driver coverage.

Additionally, it's necessary to consider the price of the plan. While price should not be the single determining factor, it is essential to locate an equilibrium between price and insurance coverage. Contrast quotes from different service providers to guarantee you're obtaining a fair rate for the protection you need.

Ultimately, make the effort to read and understand the terms of the policy. Take note of any type of exclusions or constraints that may affect your insurance coverage.

Conclusion

So, whether you're a brand-new motorist or a seasoned one, having auto insurance coverage is essential (Auto Insurance Quote Lake Worth FL). It not just offers monetary security in case of mishaps, link but likewise gives you tranquility of mind on the road. By comprehending the sorts of protection, variables affecting costs, and the advantages of having automobile insurance, you can make a notified choice when choosing the ideal service provider. Guarantee with self-confidence and drive with satisfaction understanding you're shielded.

In this article, we'll explore the world of cars and truck insurance policy, from the different coverage choices to aspects that influence your costs.The initial kind of car insurance coverage is liability insurance coverage.When identifying your cars and truck insurance policy costs, numerous variables come right into play that can significantly impact the cost. Vehicle insurance offers you with peace of mind knowing that if you are involved in an accident, your insurance will certainly cover the price of fixings or substitute of your automobile. By comprehending the types of protection, elements affecting costs, and the advantages of having cars and truck insurance coverage, you can make a notified decision when choosing the right provider.